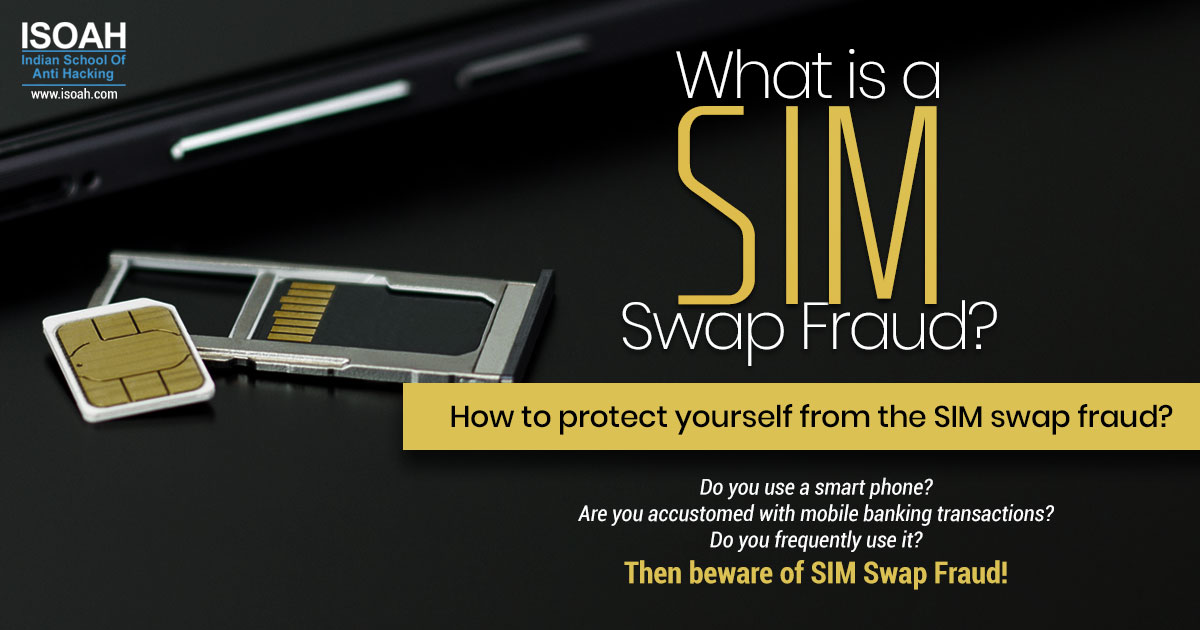

What is a SIM swap fraud? How to protect yourself from the SIM swap fraud?

Article: cyber security

Do you use a smart phone? Are you accustomed with mobile banking transactions? Do you frequently use it? Then beware of SIM Swap Fraud!

SIM swap fraud is the latest cyber fraud where attackers manage to gain access to victim's bank accounts, credit card numbers and other personal information. Several SIM Swap cases were reported in US and Europe in 2013 and recently, India is also witnessing the rise of SIM swap fraud where people have lost more than Rs.200 Crores.

Imagine the scope of the attack, if the attackers got hold of your phone number as well as Adhaar number. Now our phone number is linked with our Adhaar number and when a fraudster manages to gain both, it can lead to serious identity theft and financial as well as reputational damage.

How does it work?

In case of SIM swap, the fraudster issues a duplicate SIM card registered under your name.

- First, they would send phishing mail impersonating credit card companies or some trusted source to gain information like full name, address, date of birth, phone numbers of the target. Fraudsters also collect personal data from social media platforms or through Trojan or Malware.

- The next step is approaching the mobile service operator of the target to get the SIM blocked claiming the mobile handset is lost or the SIM card is damaged. Using the personal data of the target that they gained, the fraudsters manage to get a new SIM card retaining the old number.

- As soon as the new SIM card gets activated, the mobile operators deactivate the old, genuine SIM card of the victim and he will not receive any SMS on his phone.

- Now the fraudster got complete access to the victim's phone and can easily take advantage of the OTP alerts required for financial transactions through the bank account.

How to protect yourself from the fraud?

- If your mobile number is unavailable for a longer period than usual, enquire with your mobile operator to avoid being a victim.

- Register for SMS and Email Alerts to stay informed about the activities in your bank account.

- Check your bank account statement regularly.

- Never share the 20 digit SIM number mentioned on the back of the SIM card.

- Do not put your mobile number that is attached to your bank accounts, on public display on social media or any other website.

- Do not neglect messages sent from your network provider that highlight a probable SIM-Swap. Remember to respond quickly to such messages.